- +91 9825156357

-

Coronavirus: How to prepare for uncertain times

Uncertainty is a fact of life. There are many situations outside our control and these events can hurt your investments. While controlling the markets may be out of our reach, we can easily plan to stay protected and minimise the damage.

Here are some approaches that can help us to plan for uncertain times.

Have an emergency fund

An emergency fund is a must for a stable financial life. In case of any emergency, without an emergency fund, your entire savings may be drained. Having an emergency fund with at least three to six months of expenses will help you overcome unexpected conditions such as job loss or a health emergency.

In case of a market decline because of economic reasons or a virus outbreak like COVID 19, it is crucial to have easy access to liquid cash. In such situations, there are higher chances of cutbacks and medical emergency.

Liquid fund and savings account can help you build your emergency fund and give access to easy liquidity. Now, one can redeem their money from the liquid fund which is deposited in a savings account immediately. As per the SEBI guidelines, investors can redeem up to Rs.50,000 or 90% of the amount, whichever is lower, instantly.

Focus on your goals:

Equity markets are volatile in the short run. But, in the long run, equity markets offer higher returns than other asset classes.

In cases of extreme volatility, it is tough to maintain our cool. It is easier to make reckless judgments which can have negative effects on our portfolio. In these conditions, it is vital to pay attention and make the right investment decisions.

The best way to control impulsive reaction is to focus on your goals. Has the present scenario altered your long term financial goals? If not, there is no reason to overreact and staying invested is the best financial decision.

Don’t stop your SIP

Systematic Investment Plan (SIP) is an easy way to invest in mutual funds. We notice that investors stop their SIP investment when the markets is going through a rough phase.

However, stopping your SIP or trimming your SIP amount can have a detrimental impact on your portfolio and you may have to stick around further to complete your financial objectives.

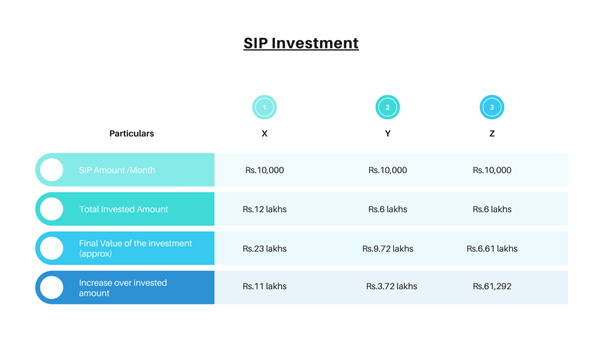

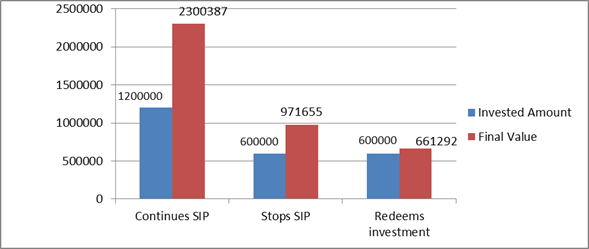

Let us show this with an example. Let us assume that three friends X, Y and Z started investing Rs.10,000 every month for 10 years.

After five years, the markets fell 10% in a single day. Till that drastic decline, equity markets gave an average return of 8%.

In this scenario, three friends took different actions. X continued with his SIP, Y stopped SIP but did not redeem the invested amount, and C stopped SIP and redeemed his entire investment.

Going forward, the market recovers and gains another 8% returns in the next five years. Overall, the market gave an average return of 12% in 10 years.

Here’s how the portfolio of X, Y, and Z would look like in 10 years.

Here, we see that X stayed invested for the entire duration, X accumulates more than Rs.23 lakhs against an initial investment amount of Rs.12 lakhs.

As Y stops SIP but does not redeem the investment, Y’s invested amount of Rs.6 lakhs increased to Rs. 9.72 lakhs.

As Z stops the SIP and redeems the entire investment after five years, he gains Rs.61,292 against his initial investment of Rs.6 lakhs.

From this example, we can see that staying invested and continuing your SIP in volatile times can help you achieve your financial goals.

Rupee cost averaging is one of the important features of SIP. Taking the SIP route allows investors to average out the cost of investment as investors receive more units of the fund when the market is down and vice versa.

Asset Allocation:

Asset allocation is the investment strategy where the investment portfolio is segregated among different asset classes, as per the risk and investment goals of the investor. It is important to revise your asset allocation regularly. Your investment goals and risk-taking capacity may change over time, and optimal asset allocation in your portfolio will make sure you are on the right track.

If your financial goals have changed, you can tweak your portfolio accordingly. A financial advisor can help you do so.

Conclusion:

Markets are volatile in the short run. Staying prepared with an emergency fund, proper asset allocation and staying invested in the market through SIP are some ways that can help you overcome testing times and achieve your financial goals.

+91 9825156357

"PCUBE HOUSE"

Near Palanpur - Ahmedabad Flyover,

Behind Mangalmurti Mart,

Palanpur - 385001

Risk Factors – Investments in Mutual Funds are subject to Market Risks. Read all scheme related documents carefully before investing. Mutual Fund Schemes do not assure or guarantee any returns. Past performances of any Mutual Fund Scheme may or may not be sustained in future. There is no guarantee that the investment objective of any suggested scheme shall be achieved. All existing and prospective investors are advised to check and evaluate the Exit loads and other cost structure (TER) applicable at the time of making the investment before finalizing on any investment decision for Mutual Funds schemes. We deal in Regular Plans only for Mutual Fund Schemes and earn a Trailing Commission on client investments. Disclosure For Commission earnings is made to clients at the time of investments. Option of Direct Plan for every Mutual Fund Scheme is available to investors offering advantage of lower expense ratio. We are not entitled to earn any commission on Direct plans. Hence we do not deal in Direct Plans.

Disclaimer | Commission Disclosure | Privacy Policy | Terms & Conditions | SID/SAI/KIM | Code of Conduct

AMFI Registered Mutual Fund Distributor | ARN- 25940 | Date of initial Registration: 24/10/2004 | Current validity: 01/07/2027

Copyright © NBB Investment. All rights reserved.