- +91 9825156357

-

With the growing complexity of retirement, more and more people are getting concerned about retirement and its planning. Once you have passed working age, it becomes difficult to Manage the expenses. During such times, careful retirement planning is the only thing, which can undoubtedly make your retirement period a golden era. Retirement planning, related term Which is often referred as allocation of financial resources so that its benefits can be fully achieved when you can no longer remain liable to work and earn.

Regardless of your age, it is never too early or too late to begin looking after Managing money. Visions of retirement vary from person to person and include such things as relaxing full time, travelling, pursuing a hobby and maybe even working part-time.

Retirement planning involves organising your assets and savings into plan that will meet your goals for retirement. Taking into account your needs, time-frame and goals, we identifies and help you to make informed decisions on a number of personalised strategies that will maximise your wealth for retirement. We can also help you with regards to Self-Managed Funds (SMF), which can give you greater flexibility, investment choice and control over your superannuation.

The planning of retirement is equally considered to be planning for a lifetime. At the time when you are hale and hearty, planning about your retirement is the only thing, which keeps your old age financial woes on side. Regardless of your age, the relevance of retirement turns out to be extremely essential for the remaining golden years of your life.

If you are confused about your retirement and are finding it difficult to think in advance then consult us today. Under the assistance of our finest personals, we promise to solve all your retirement related worries instantly.Which that can help you out in understanding how you can Manage Your Wealth.

We would certainly help you out in setting more realistic goals towards your desire for portfolio management. Isn’t is good to decide about retirement in advance than remaining worried during those time when you can no longer earn?

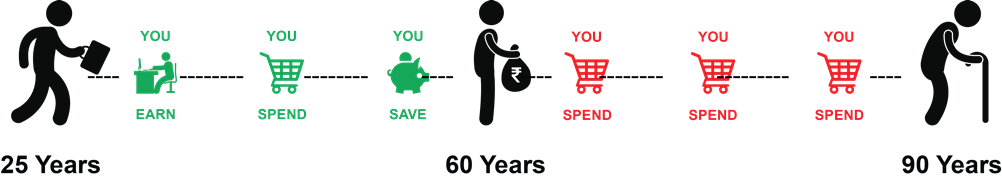

With people living longer till 85-90 years, the conversations and concerns around retirement have grown. One might think that they will not live too long. But what if you live a lot longer than what you thought? Who will pay for you?

+91 9825156357

"PCUBE HOUSE"

Near Palanpur - Ahmedabad Flyover,

Behind Mangalmurti Mart,

Palanpur - 385001

Risk Factors – Investments in Mutual Funds are subject to Market Risks. Read all scheme related documents carefully before investing. Mutual Fund Schemes do not assure or guarantee any returns. Past performances of any Mutual Fund Scheme may or may not be sustained in future. There is no guarantee that the investment objective of any suggested scheme shall be achieved. All existing and prospective investors are advised to check and evaluate the Exit loads and other cost structure (TER) applicable at the time of making the investment before finalizing on any investment decision for Mutual Funds schemes. We deal in Regular Plans only for Mutual Fund Schemes and earn a Trailing Commission on client investments. Disclosure For Commission earnings is made to clients at the time of investments. Option of Direct Plan for every Mutual Fund Scheme is available to investors offering advantage of lower expense ratio. We are not entitled to earn any commission on Direct plans. Hence we do not deal in Direct Plans.

Disclaimer | Commission Disclosure | Privacy Policy | Terms & Conditions | SID/SAI/KIM | Code of Conduct

AMFI Registered Mutual Fund Distributor | ARN- 25940 | Date of initial Registration: 24/10/2004 | Current validity: 01/07/2027

Copyright © NBB Investment. All rights reserved.